Dividends

Dividends policy

The Company believes its prioritization of strategic investments as well as capital expenditures for sustainable profit growth and improving corporate value will benefit its shareholders. In addition, the Company views an appropriate shareholder return as one of its core management principles. While giving due consideration to providing a stable return and maintaining robust internal reserves for the future, the Company intends to pursue a comprehensive shareholder return policy that also takes into account its business results and future funding needs.

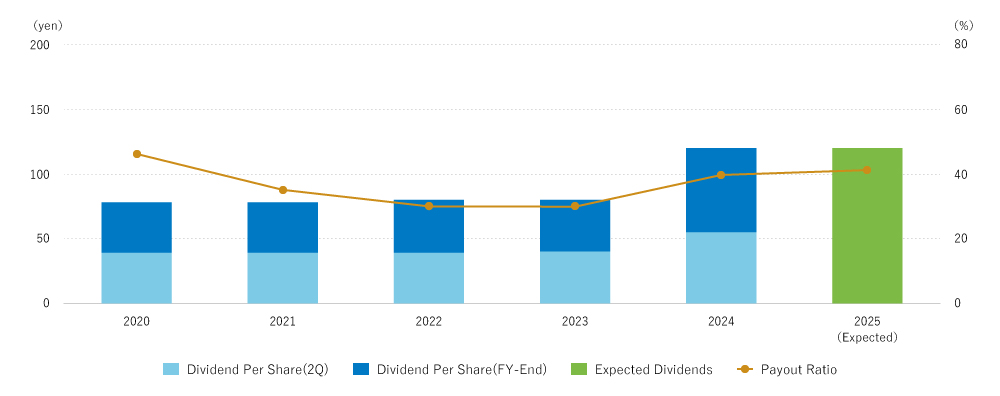

Specifically, the Company aims to stably increase dividends on the basis of profit growth with a targeted consolidated payout ratio of 40% or more of profit for the year attributable to owners of the Company.

The Company’s basic policy on dividend payments is to pay dividends twice a year in the form of interim dividends and year-end dividends.

In order to enable agile dividends of surplus, etc. without requiring a resolution of the General Meeting of Shareholders, even when it may be difficult to hold an Ordinary General Meeting of Shareholders due to the occurrence of unforeseen circumstances, the Company stipulates in its Articles of Incorporation the following: “The company may, by resolution of a meeting of the board of directors, determine the matters provided for in each item of Article 459, paragraph (1) of the Companies Act, including dividends from surplus, except as otherwise provided for in laws and regulations.” Accordingly, the Company’s system allows for a resolution on dividends, etc. to be passed by either a General Meeting of Shareholders or the Board of Directors.

The record date for the interim dividend is stated in the Articles of Incorporation as June 30.