In order to sustain business and continue to create value, Suntory Group believe it is necessary to identify risks due to climate change as well as their potential impact on business and respond appropriately.

In May 2019, Suntory Group declared its support for the Task Force on Climate-related Financial Disclosures (TCFD) recommendations established by the Financial Stability Board (FSB), and makes disclosures based on the recommendations annually.

Starting in 2022, in addition to assessing and identifying the risks and opportunities that the problem of climate change presents to society and corporations, we started to estimatee the monetary impacts on our business. Going forward, we will aim to enhance our resilience to these impacts by incorporating adaptive measures into our strategies to address risks and opportunities as they become evident. We will also continue to expand disclosure of related information.

1. Governance

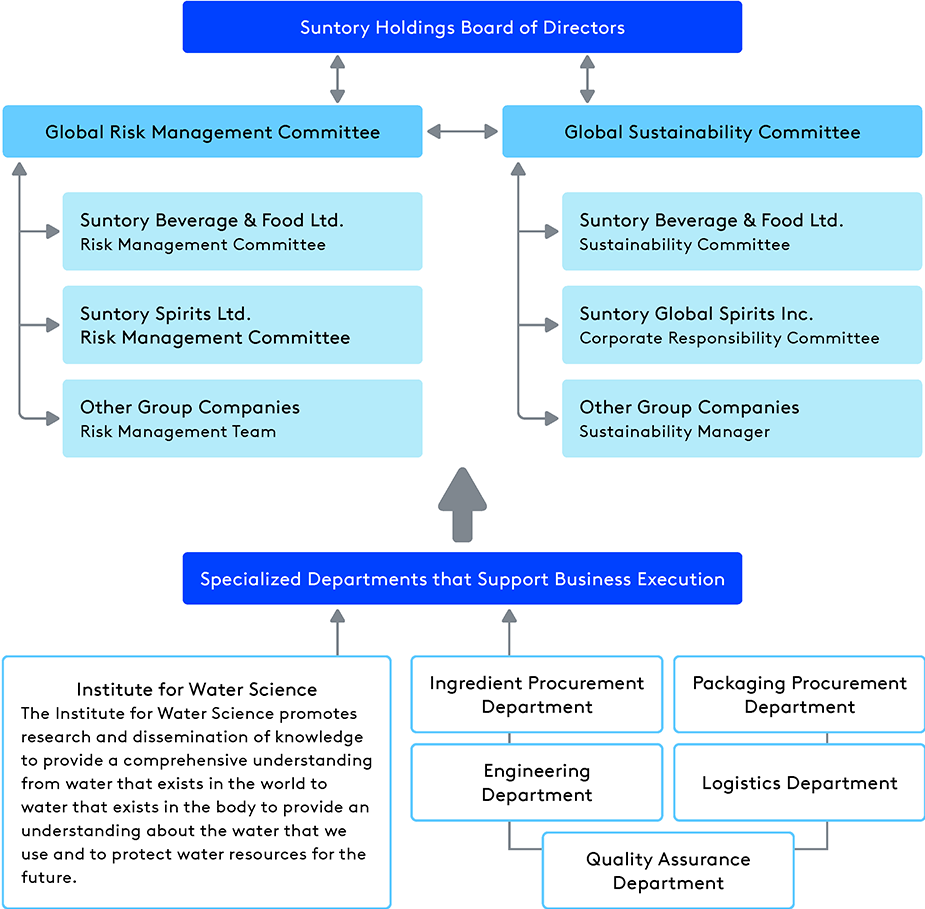

The Global Risk Management Committee (GRMC) strengthens risk management throughout the entire Group. We have established a risk management committee and risk management team based on this GRMC (e.g. installation of a Risk Management Committee at Suntory Spirits Ltd. and Suntory Beverage & Foods Ltd., etc., the Global Risk & Compliance Committee at Suntory Global Spirits Inc., and the Risk Management Team at other Group companies). Meeting four times a year, the GRMC identifies the entire Group’s risks, executes countermeasures, and engages in activities related to the establishment of crisis management systems. Climate related risks, one of the most important risk categories, are discussed by the GRMC and the responses to those risks are then monitored.

The Global Sustainability Committee (GSC) discusses medium- to long-term strategies relating to the seven themes defined by the Sustainability Vision, including climate action. In addition, we have established committees at each business in order to hold discussions about more specific strategies and initiatives (e.g., the Sustainability Committee was established at Suntory Beverage & Foods Ltd. and the Corporate Responsibility Committee was established at Suntory Global Spirits).

The GRMC and GSC are in constant cooperation, and important matters to be discussed are further deliberated and resolved by the Board of Directors. Progress in implementing strategies related to climate change, and business risks and growth opportunities are reported to the Board of Directors on a quarterly basis. In addition, the Board of Directors provides opportunities to receive advice on climate change and sustainability management, such as by regularly holding study sessions led by invited external experts.

Climate related KPIs are set in the management strategy meeting. The CEO is responsible for climate related issues and the Chief Sustainability Officer is responsible for assessment of climate-related risks and opportunities as well as their management. Business performance targets that determine officer remunerations include sustainability targets.

Organizational Chart

2. Strategy

Suntory Group assesses climate change related issue based on their importance. For risks and opportunities that are expected to have a large impact on business, we have set medium- to long-term targets and are proceeding with initiatives.

As the approach to identifying risks and their assessment, we create an evaluation of the identified risks based on the two axes of "Risk Exposure" and "Degree of Response." In particular, we categorize major Group-wide risks as Tier 1 through Tier 3, with Tier 1 being most important risk and Tier 2 important risk. "Risk Exposure" is calculated by probability of occurrence (probability) x magnitude of impact (impact), and "Degree of Response" is calculated by the degree of preparation for countermeasures. As a result of the evaluation, climate-related risks are positioned as one of the most important risk types.

With consumers, investors, and other stakeholders increasing interest in GHG emissions by corporations, we recognize that risks and opportunities related to climate change may greatly affect our business strategy. We conduct scenario analysis to understand and take measures against risks and opportunities related to climate change that may impact business and consider them during financial planning.

Risks and Opportunities (Identify risks and opportunities, estimate the amount of monetary impact)

To identify important financial risks and opportunities for an organization, impact and frequency of each item in the span of short (0 to 3 years), medium (3 to 10 years), and long (10 to 30 years) term were considered. Result of the internal assessment is organized and shown below. Of the identified risks and opportunities, we recognized that increase in costs due to introduction of carbon tax, opportunity loss due to insufficient supply of water at production sites, and increase in raw material costs due to decrease in yield of agricultural products are the three items that may have a significantly impact and estimated the amount of their monetary impact on business. For the basis of analyzing risks and opportunities, we used RCP 8.5 as global warming scenario and IEA NZE 2050 and other scenarios as decarbonization scenario.

| 1. Identify major risks and opportunities | 2. Assess the impact of each risks and opportunities on business (For most important risk, estimate the amount of monetary impact) |

3. Determine/conduct response measures | ||

|---|---|---|---|---|

| Types of Risks and Opportunities | Estimated impact on business | Measures to reduce risks/seize opportunities | ||

| Transit ion Risk |

New regulation |

Increase in production costs due to introduction of carbon pricing |

|

|

| Physic al risks |

Chronic risks |

Impact of insufficient supply of water on operation of production sites |

|

|

| Increase in procurement costs due to decline in yield of agricultural products |

|

|

||

| Acute risks |

Flood, etc. caused by large typhoon or heavy rain |

|

|

|

| Opport unities |

Products/ Services |

Impact on health due to rising temperatures |

|

|

| Change in consumer behavior due to increased environmental awareness |

|

|

||

| Resource efficiency |

Cost reduction due to introduction of new technology |

|

|

|

-

Note 1:Estimated using our Scope 1 and 2 emissions in 2019 and carbon tax price independently estimated based on forecast figures of the International Energy Agency (IEA)’s “Net Zero by 2050: A Roadmap for the Global Energy Sector (NZE).”(Exchange rate as US$1 = JPY146)

● 2030: Japan, Europe, and Americas. US$140/ton, APAC US$90/ton.

● 2050: Japan, Europe, and Americas. US$250/ton, APAC US$200/ton. -

Note 2:Estimated impact on profit if all plants located in areas with high level of water stress have restriction on water withdrawal. Aqueduct 3.0 Country Rankings developed by World Resources Institute and Water Risk Filter 6.0 developed by World Wide Fund for Nature (WWF) are used for assessing water stress level of areas where our plants are located in.

(Exchange rate as US$1 = JPY146)

We aim to resilient by considering both scenarios and taking strategic approach toward the above actualized risks and opportunities. We have been focusing on identifying water supply risks, proper management of water, water resource cultivation activities, and other water sustainability activities but are considering risks related to raw material procurement and other aspects. In addition, in order to reduce GHG emissions throughout the value chain, from raw material procurement to manufacturing, distribution, sales, and recycling, we set challenges for each department and take action. For opportunities, we are expanding product portfolio of beverages with ingredients which are recommended by the Ministry of Environment of Japan as products addressing climate change. We believe that continuing and enhancing water resource cultivation activities, "Mizuiku" - Natural Water Education Program and other activities related to water as well as sharing information about Suntory Group’s approach to water to the public will raise are brand value and lead to increased sales. In terms of resource efficiency, we are actively promoting recycle of plastic bottles.

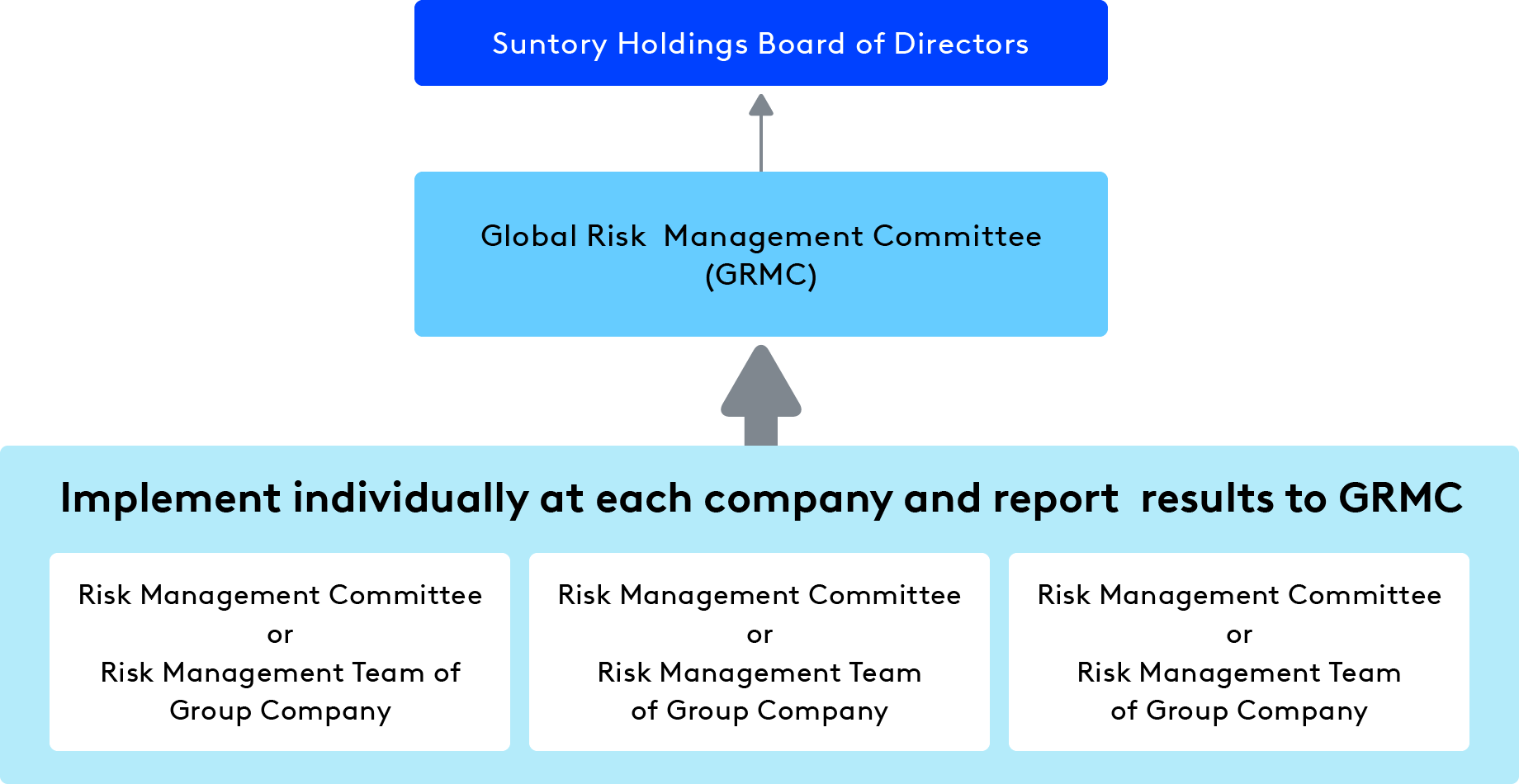

3. Risk Management

We define risk as current and future uncertainties that may affect the execution of business strategy and the achievement of business objectives. Through the Global Risk Management Committee (GRMC) and the risk management committees and risk management teams established at each group company, we identify and evaluate climate change and other important risks for the entire group and identify risks that should be prioritized for our company, consider countermeasures, and reviewing them on an annual basis.

Risk Management System

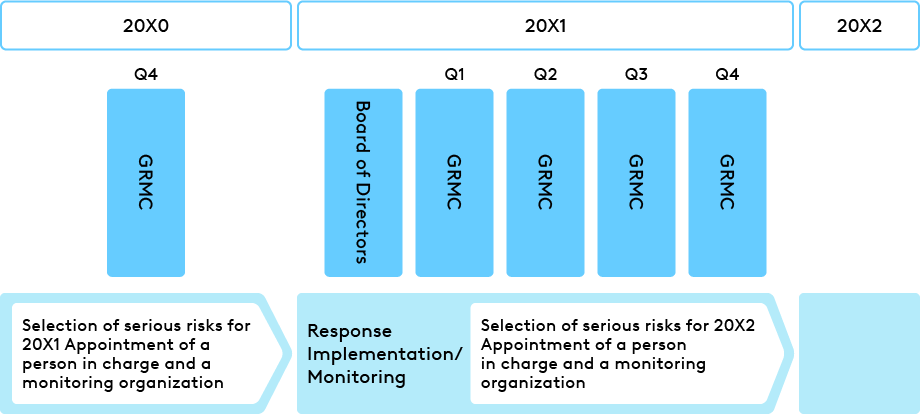

Approach to Managing Identified Risks

For the identified risks that should be prioritized, a person in charge and a monitoring organization will be appointed to implement the risk countermeasures. The response status is reported and discussed by the Global Risk Management Committee (GRMC), and the PDCA cycle of extraction, evaluation, countermeasures, and monitoring is carried out by selecting important risks for the next fiscal year based on the response results.

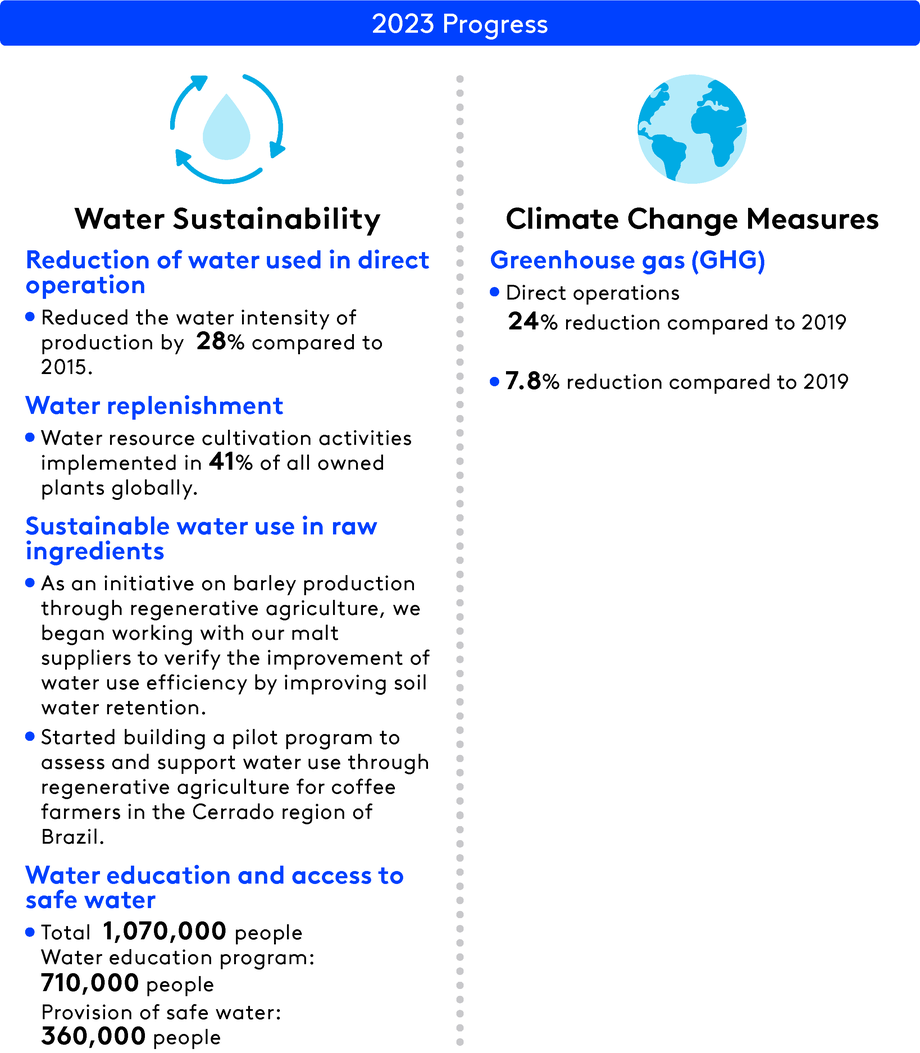

4. Indicators and Targets

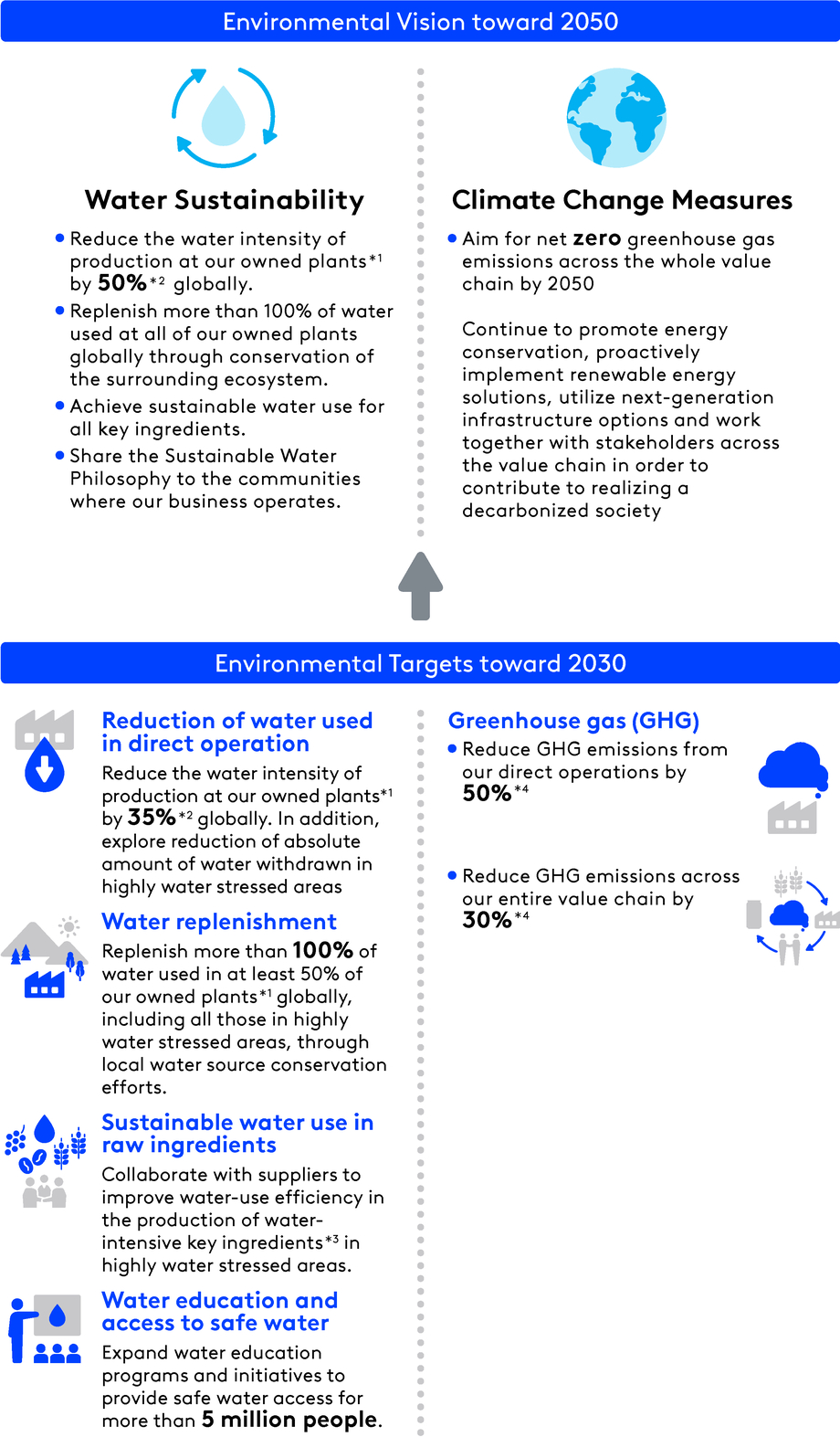

Regarding climate change and water, which are expected to have a large impact on business, Suntory Group has established "Environmental Targets toward 2030" as the medium-term targets with 2030 as the target year and "Environmental Vision toward 2050" as the long-term vision with 2050 as the target year, and are moving ahead with initiatives.

-

*1Suntory Group plants that manufactures finished products

-

*2Reduction per unit production based on the business fields in 2015

-

*3Coffee, barley, grapes

-

*4Based on emissions in 2019

Initiatives

Water

To achieve the 2030 target, Suntory Group is globally promoting various water-related initiatives such as activities to conserve and restore the natural environment. We started the Natural Water Sanctuary Initiative to cultivate water resources in forests in 2003. Now we have 26 Suntory Natural Water Sanctuaries in 16 prefectures which cover a total area of more than 12,000 hectares and supply more than twice the amount of water used by our plants in Japan. In 2023, we received the highest level of certification—Platinum—from the Alliance for Water Stewardship, an internationally prestigious organization that promotes water conservation and stewardship (responsible management of water resources). Four Suntory Group plants currently hold AWS certification.

Climate Action

Suntory Group has switched purchased electricity to 100% renewable in all our 63 manufacturing sites and R&D facilities in Japan, the Americas and Europe by 2022. In addition, we introduced internal carbon pricing to from 2021 and plan to invest a total of approximately 100 billion yen by 2030 to promote decarbonization. The company estimates that these actions together will amount to a reduction of approximately 1 million tons of greenhouse gas (GHG) emissions in its direct operations compared to a business-as-usual projection for 2030. In addition, in 2022 Suntory Group signed a basic agreement with Yamanashi Prefecture to realize an environmentally harmonious and sustainable society, with the aim to introduce, by 2025, a 16-megawatt Yamanashi Model Power-to-Gas (P2G) System. This will become Japan’s largest facility for green hydrogen production, and will be located at the Suntory Minami Alps Hakushu Water Plant and Suntory Hakushu Distillery. With this system, Suntory plans to convert the heat energy used at the plants to green hydrogen, as well as study and collaborate with the prefecture regarding the use of green hydrogen in the area.

For GHG-related measures, we are reducing Scope 3 emissions through strengthening recycling of plastic bottles as well as starting project on regenerative agriculture. We have also approached raw ingredient suppliers to kick start collaborations.